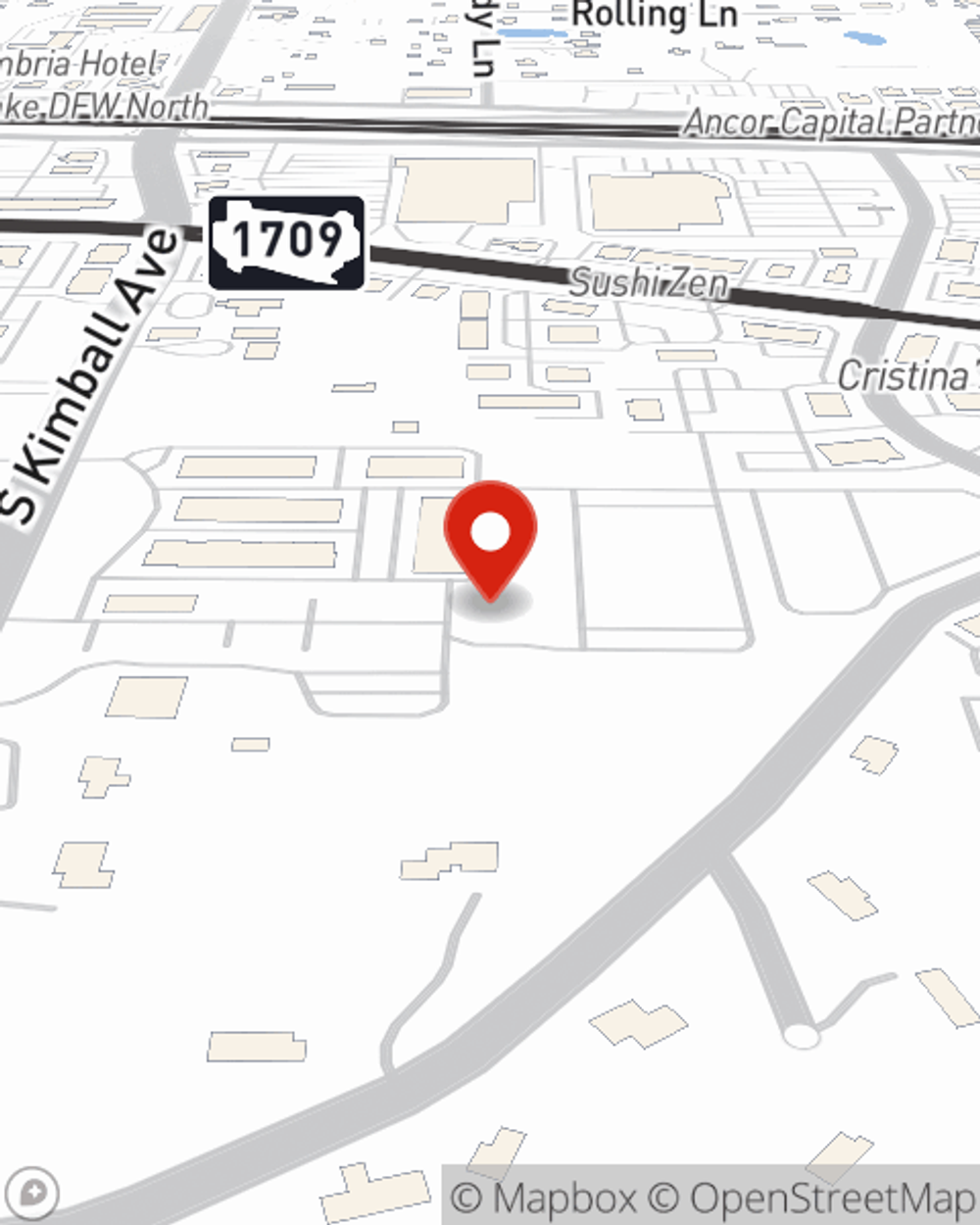

Life Insurance in and around Southlake

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

When you're young and just starting out in life, you may think Life insurance isn't necessary when you're still young. But it's a good time to start thinking about Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with meeting the needs of children, life insurance is a critical need for young families. Even if you don't work outside the home, the costs of paying for domestic responsibilities or daycare can be a heavy weight. For those who don't have children, you may have debt that your partner will have to pay or be financially responsible to business partners.

No matter what place you're at in life, you're still a person who could need life insurance. Talk to State Farm agent Bill Tait's office to find out the options that are right for you and your family.

Have More Questions About Life Insurance?

Call Bill at (817) 251-8900 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.